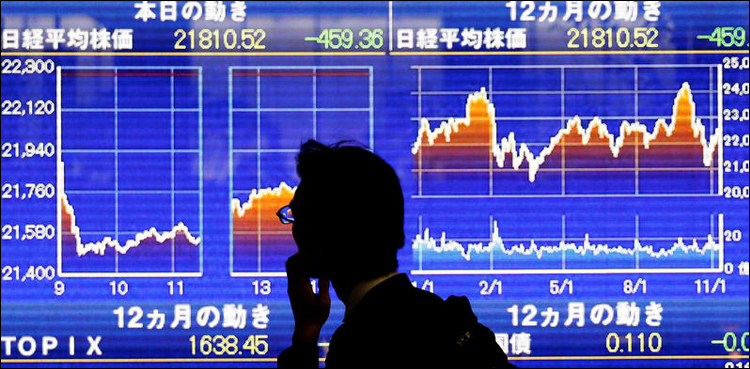

NEW YORK: Asian shares were set to dip in choppy trade on Friday as worries about worsening US-China ties offset the fillip from hopes massive government stimulus can jump-start the world economy.

E-Mini futures for the S&P 500 ESc1 edged down 0.12% in early Asian trade, while Nikkei futures NKc1 pointed to a loss of 10 points. Weaker Australian stock futures YAPcm1 also indicated a softer open.

Underscoring the ambivalence in markets, US stocks slid from a near three-month high in a late sell-off overnight, after US President Donald Trump signed an executive order that would weaken laws protecting social media companies, and said he’d hold a news conference about China on Friday.

In the latest dispute between the world’s two biggest economies, the US government has signaled plans to punish Beijing for proceeding with a national security law for Hong Kong that critics fear would erode the city’s freedoms.

All eyes are now on Friday’s press conference hosted by Trump where he will address his response to China over its treatment of Hong Kong.

It is not clear if Trump will rescind some, none, or all of the US economic privileges that Hong Kong enjoys under US law. Larry Kudlow, Trump’s top economic adviser, said on Thursday Hong Kong may now need to be treated like China on trade and other financial matters, which could have implications for tariffs and stock market listings.

“Risk appetite quickly disappeared after President Trump announced he would address China tomorrow at a press conference. It didn’t take much to help traders rush to exits,” Edward Moya, a senior market analyst at currency trader Oanda, wrote in a note.

If tensions between China and the United States intensify, a build-up of short positions in the S&P 500 index, or bets that the index will fall, could spark a sell-off in shares, Moya added.

Stock markets have rebounded from lows hit in mid-March on hopes that enormous government stimulus could help the world economy recover more quickly than expected from the coronavirus shutdown. Some analysts have warned, however, that such optimism is misplaced given the extent of economic devastation.

Indeed, the latest US data showed the economy may be stabilising, but at a much lower level.

Figures released overnight showed the number of Americans seeking jobless benefits fell for an eighth straight week last week, but claims remained astonishingly high.

In a sign investors are undecided about how much risk to take on, prices for safe-haven gold rose, even as the U.S. dollar and Japanese yen — in demand when investors shy from risk — softened.

Spot gold XAU= was slightly firmer at $1,718.87 per ounce from $1,712.35 seen overnight.

The dollar index =USD slipped 0.4% to 98.51, held back in part by a stronger euro EUR=, as the common currency continued to bask in the glow of a 750-billion-euro coronavirus recovery fund for the European Union.

The euro was firm at $1.1073 against the dollar, near a two-month high of $1.1087, while the yen edged down 0.07% to 107.07 on the dollar.

The post US-China tension to push Asian shares lower in choppy trade appeared first on ARY NEWS.

from ARY NEWS https://ift.tt/3er2BxF

Comments

Post a Comment